Savers switching from annuities to income drawdown after pension changes

At retirement you have two choices:

1. Convert your pension into income by purchasing an annuity

2. Keep the pension invested and withdraw money when you need it; this is called income drawdown.

Latest figures from the Association of British Insurers (ABI) show that people over 55 are moving away from buying annuities towards income drawdown policies. We’ve noticed the trend growing for a few years, but it has definitely strengthened since the new pension rules came into force in April.

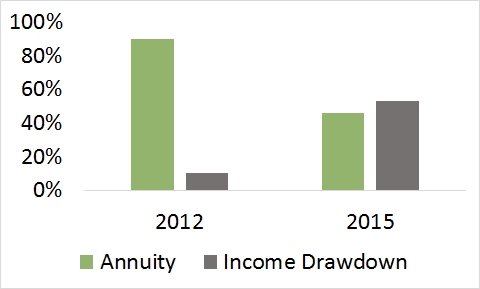

Of those buying a retirement income in the two months after 6th April 2015, 53% chose an income drawdown policy, while 46% chose an annuity. Just three years ago, in 2012, annuities accounted for 90% of policies purchased.

65,000 people exercised their new right to withdraw cash – taking out more than £1bn, the ABI said.

So what were the April 2015 pension changes exactly?

- People aged 55+ are allowed to withdraw any amount from a Defined Contribution (DC) – also known as a ‘money purchase’ – pension scheme, subject to income tax

- Tax changes have now made it easier to pass pension savings on to descendants

- Many people with Defined Benefits (DB) – also known as ‘final salary’ – pension schemes will be allowed to transfer to DC plans

(Existing annuity holders are unaffected for the time being.)

What are Annuities?

Most people buy an annuity with a lump sum of cash from their pension pot; an annuity gives you a guaranteed, taxable income for the rest of your life, giving you certainty throughout your retirement. If you have a relatively small pension, an annuity is probably the right option for you, however it does not give you the flexibility of income drawdown.

Where can I get one?

Your pension provider will offer you an annuity but your adviser should shop around for the best deal, taking the ‘open market option’. This can increase your annuity income by as much as 20%. If you have health problems, consider an ‘enhanced annuity’ which pays you more because you are expected to live for a shorter time. See our blog ‘Enhanced and Impaired Life Annuities for a higher retirement income’.

What is Income Drawdown?

This option will allow you to take the tax free lump sum immediately, from the age of 55 onwards, and leave the remaining pension pot invested which can be used to either provide an income within government defined amounts known as GAD (Government Actuary’s Department) rates or an income can be deferred, up to the age of 75, until you decide to take an annuity. It is more risky than purchasing an annuity, because your pension remains in investments that may go up or down, so your future income may do so as well. However, it does allow you to benefit from future increases in the stock market and you can manage your cash flow better because you only draw the income when you need it.

Where can I get one?

Income drawdown is a complex area and we recommend that you speak to an Independent Financial Adviser specialising in this area who will be able to tell you more about the different variations of drawdown products that are available in the market place and whether they are suited to you.

Next steps

If, having read this blog, you’re still not sure which option is the best for you, then please call Marchwood IFA now and ask us to review your pension arrangements. We can help you make the right decisions to help you achieve your retirement goals.